The deferred comp plan prides itself on providing a simple, yet custom investment lineup built specifically for Missouri savers.

The cornerstone of our investment options are the Missouri Target Date Funds, which provide professionally-managed, broadly-diversified portfolios named for different retirement dates. The asset allocations within these target date funds adjust automatically over time. Each fund invests more aggressively in its early years and becomes more conservative as it reaches its time horizon.

We also provide access to a stable income investment option and a brokerage window through Charles Schwab. Together, these options make the deferred comp plan an attractive retirement account for a variety of savers.

Investment Option Details

Manager: Voya Financial

Ticker: N/A

Category: Stable Value

Objective: Seeks to offer protection of principal and the potential for steady growth over time without the daily fluctuations that other investment options may experience.

Strategy: To outperform the Bloomberg U.S. Aggregate Bond Index, while at the same time, protecting principal.

Please note that earnings for the Missouri Stable Income Fund accrue daily and will post to participants' accounts at the end of the month.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent with the Fund’s asset mix.

Strategy: The Missouri Retirement Allocation Fund is a diversified portfolio of equities and bonds built for retired investors, typically those born in 1942 or before. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2010 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2010, typically those born between 1943 and 1947. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2015 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2015, typically those born between 1948 and 1952. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2020 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2020, typically those born between 1953 and 1957. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2025 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2025, typically those born between 1958 and 1962. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

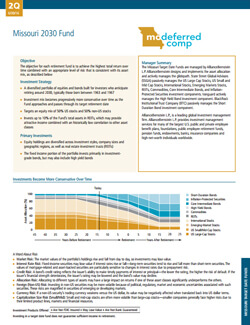

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2030 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2030, typically those born between 1963 and 1967. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2035 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2035, typically those born between 1968 and 1972. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: Missouri 2040 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2040, typically those born between 1973 and 1977. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Ticker:

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2045 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2045, typically those born between 1978 and 1982. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2050 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2050, typically those born between 1983 and 1987. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2055 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2055, typically those born between 1988 and 1992. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2060 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2060, typically those born in 1993 or after. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

Manager: AllianceBernstein designs and implements the asset allocation and actively manages the glidepath. The investment portfolios underlying the Missouri Target Date Funds are managed by State Street Global Advisors, Vanguard, and BlackRock.

Category: A custom target date separate account (not a mutual fund).

Objective: Seeks the highest total return over time, consistent the Fund’s asset mix.

Strategy: The Missouri 2065 Fund is a diversified portfolio of equities and bonds built for investors who anticipate retiring around 2065, typically those born in 1998 or after. Over time, professional fund managers gradually adjust the investments, so the investment mix makes sense for your age. Funds that are farthest away from their target dates start out invested almost entirely in equities to emphasize the growth potential you need to build wealth over the long term. As you move closer to retirement, the Fund automatically adjusts to a more conservative mix of investments. That means fewer equities and more bonds. So by the time you move into retirement, the Fund will be more focused on protecting principal and generating income.

The Self-Directed Brokerage (SDB) Account is for hands-on investors and should not be entered into without an understanding of the available investment options and their associated risks. A participant in the Self-Directed Brokerage Account bears the ultimate responsibility for selecting investments within this option. The State of Missouri Deferred Compensation Plan and its affiliates will not provide any advice concerning individual investment selections in the Self-Directed Brokerage Account. Prior to using the self-directed brokerage account, you must acknowledge and sign the Waiver for Participation within Account Access.

The Self-Directed Brokerage (SDB) Account is a brokerage option that offers you investment flexibility. Through the SDB, you will have access to most individual stocks and bonds, and more than 13,000 mutual funds, including 1,300 no-load, no-transaction-fee funds.*

- Self-Directed Brokerage Account - Everything You Need to Know!

General information and frequently asked questions about the Roth-only brokerage account option

Online Enrollment

- Log on to Account Access in the right sidebar.

- Choose the Investments tab.

- Click on Brokerage in the left menu.

- Follow the instructions provided (enrollment typically takes less than five minutes to complete).

Managing Your Account

Once your account is open, you may make your initial transfer into the SDB through the Manage Funds section of the website or by calling the State of Missouri Deferred Compensation Plan Information Line at 800-392-0925.

Once the money is in your brokerage account, you can then invest in the more than 13,000 mutual funds available. You may do this by calling the State of Missouri Deferred Compensation Plan Information Line or by calling Charles Schwab directly at 888-393-7272, Monday – Friday, 8:30 a.m. to 6:30 p.m. (except New York Stock Exchange holidays). You must maintain a minimum balance of $500 in the State of Missouri Deferred Compensation Plan and may transfer any remaining Plan account balance into the SDB. You can also direct up to 90% of your investment elections to the SDB. There is no annual fee to participate in the SDB, however, transaction fees may still apply. All fees are outlined in the Schwab Pricing Summary document.

* A short-term redemption fee of $49.99 applies to no-load, no-transaction fee mutual funds for shares held 90 days or less.

Charles Schwab & Co., Inc. and MissionSquare are not affiliated and are not responsible for the products and services provided by the other. Schwab Personal Choice Retirement Account® (PCRA) is offered through Charles Schwab & Co., Inc. (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers.

IMPORTANT: Missouri Target Date Fund Frequent Trading Policy

The Plan’s Frequent Trading Policy defines frequent trading as “a buy followed by a sell, three times in the same fund during a 90 calendar day period, or as a buy followed by a sell, 10 times in the same fund within a 365 calendar day period.” The buy and sell do not have to be consecutive and only investor-initiated fund transfers are considered in this process. The Plan's record keeper, MissionSquare Retirement, monitors buys and sells across all accounts and all funds that it record keeps, and if frequent trading is detected in a fund(s), they will impose a temporary restriction(s) on transfers into that fund(s) for a period of 180 days. Should frequent trading activity continue, MissionSquare Retirement reserves the right to impose a permanent restriction(s) on transfers into the fund(s) it is detected in. Restrictions only apply to buys, and sells are never blocked.

Missouri Target Date Funds Frequent Trading Policy Questions & Answers

Investments Closed to New Investors

IMPORTANT: The MOSERS Investment Portfolio (MIP) Fund was closed to new investors as of July 1, 2017.

Manager: MOSERS

Category: Actively Managed Asset Allocation Fund

Objective: Ensure the security of retirement benefits that are owed to retirees and their beneficiaries and to responsibly minimize the future financial burden on the State of Missouri.

Strategy: MIP’s investment strategies are designed to achieve long-term total returns (comprised of capital appreciation and income). MIP is a diversified portfolio of investments in multiple asset classes, including public equity, public debt, real estate, commodities, emerging markets, private equity, distressed debt, timber, foreign currency transactions, derivative transactions, and hedge funds.

PLEASE NOTE: Some funds listed in the performance, expenses and pricing information can no longer receive transfers in, but can receive contributions as long as those investment allocations were determined and finalized prior to May 1, 2009.

Plan participants that personally signed an opt-out election form to remain in mutual funds that were closed to new investors as of May 1, 2009 invest in these funds at their own risk and are solely responsible for all losses and expenses resulting from that decision. These mutual funds are not a part of the state of Missouri deferred compensation plan’s core fund line-up.

Only the line-up consisting of the Missouri Target Date Funds, Missouri Stable Income Fund and the Self-Directed Brokerage (SDB) can be used to construct new investment allocations. Any alteration of the original 100% of investment allocations will forfeit a participant's ability to continue contribution to the eliminated (frozen) options.

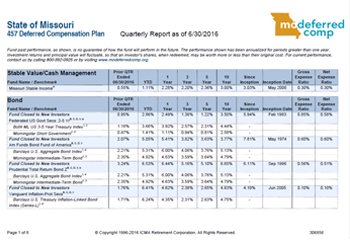

3rd Quarter 2024 Performance (for period ended 9/30/2024)

Learn More About Missouri Target Date Funds

View Missouri Target Date Fund Asset Allocations

Review Historical Fund Performance and Expenses

View Current Fund Prices

Access Brokerage Account