Holiday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, January 2, 2023, in observance of New Year's Day. Due to the holiday, transactions received via Account Access after 3:00 p.m. (CT) on Friday, December 30, 2022, will be processed as of the close of business on Tuesday, January 3, 2023. Transactions will not be processed on Monday, January 2, 2023.

Have a great holiday!

Holiday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, December 26, 2022, in observance of Christmas Day. Due to the holiday, transactions received via Account Access after 3:00 p.m. (CT) on Friday, December 23, 2022, will be processed as of the close of business on Tuesday, December 27, 2022. Transactions will not be processed on Monday, December 26, 2022.

Have a great holiday!

DC Update - It's the Most Wonderful Time of Your Career

Learn why saving with MO Deferred Comp could make your retirement the most wonderful time of your career in this DC Update.

Watch the DC UpdateDC Update - Market Volatility: Don't Make Emotional Decisions

Don’t let emotional decisions dictate your fantasy football roster, and most importantly, your investment strategy! Learn why you should keep your sights on the long run in this DC Update.

Watch the DC UpdateMissouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective first quarter 2023 (January 1 – March 31, 2023) will be 2.41%.

DC Update - 2023 Contribution Limits

Are you looking to save more for your future and max out your contributions to the MO Deferred Comp Plan? Check out this DC Update to learn more about the IRS contributions limits for 2023.

Watch the DC UpdateDC Update - History of the MO Deferred Comp Plan

Have you ever wondered how the MO Deferred Comp Plan got its start? This DC Update is jam-packed with information on how the plan came to be, monumental changes made along the way, and more!

Watch the DC Update2022 Survey Results

The results are in! Thank you everyone who participated in the 2022 Retirement and Savings Surveys. The feedback received will help MO Deferred Comp better understand participants' needs and ultimately improve education efforts.

VIEW SURVEY WINNERS & RESULTSIRS Announces Contribution Limits for 2023

The Internal Revenue Service announced on October 21, 2022 that the maximum annual contribution limits for 457(b) plans and the income limits for the Saver’s Credit will increase in 2023. Read the full article for more information.

Read More2022 National Retirement Security Month

When you're building a house, a deck, or even hanging a picture, measuring incorrectly can cost you time, materials, and money. However, when it comes to your retirement, inaccurately measuring or estimating your future retirement income needs can cost you a whole lot more. Join us for National Retirement Security Month and learn how you can "Measure Twice. Retire Once."

Learn MoreWhere can you find your match money in your online account?

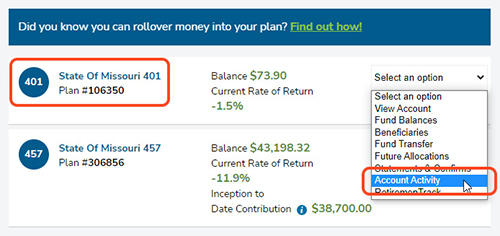

To view your state match within your MO Deferred Comp account, please follow the below steps.

- Log in to your account by clicking the blue Log In button at the top of www.modeferredcomp.org or through the ESS Portal.

- Select Account Activity from the 401 drop down box in the middle of the page.

- Monthly match amounts from the State of Missouri are listed in your 401 Account Activity as follows:

Please remember, your state deferred comp match is based on your total monthly 457 contributions to the MO Deferred Comp Plan, and match money will be deposited into your employer 401(a) retirement savings account one time during the month following your contributions.

Missouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective fourth quarter 2022 (October 1 – December 31, 2022) will be 2.49%.

2022 Retirement & Savings Survey

The MO Deferred Comp Plan is working hard to ensure we are meeting your retirement savings needs. Help us better serve you by providing valuable feedback in our short survey, plus you could win an Amazon gift card and loads of other prizes!

Please click the appropriate survey and age group below to begin:

- Retirement Awareness Survey - active employees age 35 and under

- Retirement Readiness Survey - active employees 36 and older

- Retirement Survey - those retired from state employment

Take the survey

Match Timing

As a reminder:

- The state deferred comp match is based on your total monthly 457 contributions to the MO Deferred Comp Plan, and

- The match money will be deposited into your employer 401(a) retirement savings account one time during the month following your contributions.

For example, the state match for your contributions for the month of July will be deposited approximately 5 days after August 15, 2022. The state match for your contributions for the month of August will be deposited into your account approximately 5 days after September 15, 2022 and so on.

If you have questions about the amount of your state match or about line items on your paystub, please contact your employer. The MO Deferred Comp Plan does not control or have access to your payroll information.

DC Update - When in doubt, ride it out!

Like riding a horse, investing can be full of ups, downs, twists, and turns. If you want to be a smart investor, you must learn to take the good with the bad and ride through those rough times.

Watch the DC UpdateDC Update - Meet Your State MATCH

If you contribute at least $25 a month to your MO Deferred Comp 457 account, the State of Missouri will match your contributions dollar-for-dollar up to a maximum of $75 each month. Watch our recent DC Update for more information on the state match.

Watch the DC UpdateDC Update - Target Date Funds: Getting You TO and THROUGH Retirement

Target date funds have proven to be the simplest way for state employees to invest for retirement. Planning to retire in 2025? There's a target date fund for that. Looking to retire in 2058? There's a fund for that, too. Whatever date you plan to retire, MO Deferred Comp has you covered.

Watch the DC UpdateMeet Your State MATCH

Great news! Effective July 1, 2022, if you contribute at least $25 a month to your MO Deferred Comp account, the State of Missouri will match your contributions dollar-for-dollar up to a maximum of $75 each month. As a state of Missouri employee, those additional dollars saved can make a significant impact on your future retirement income.

Read MoreHoliday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, July 4, 2022, in observance of Independence Day. Due to the holiday, transactions received via Account Access after 3:00 pm CT on Friday, July 1, 2022, will be processed as of the close of business on Tuesday, July 5, 2022. Transactions will not be processed on Monday, July 4, 2022. Have a great holiday!

The markets are struggling, what should you do?

Does the current market performance have you panicking? How you should handle a market downturn depends on your career stage and risk tolerance, however, one thing remains consistent for all: take a deep breath and remained focused on your long-term strategy.

Read MoreHoliday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, June 20, 2022, in observance of Juneteenth National Independence Day.

Due to the holiday, transactions received via Account Access after 3:00 pm CT on Friday, June 17, 2022, will be processed as of the close of business on Tuesday, June 21, 2022. Transactions will not be processed on Monday, June 20, 2022.

Missouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective third quarter 2022 (July 1 – September 30, 2022) will be 2.20%.

DC Updates - Spring 2022

The spring 2022 DC Updates cover topics including ways you can make the most of your recent pay raise, and learn how inflation can affect your retirement income and what you can do to combat it.

View the 2022 Spring DC UpdatesMissouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective second quarter 2022 (April 1 – June 30, 2022) will be 1.92%.

Retirement Savings MythBusters

Myth or Fact? Join us during America Saves Week as we debunk common retirement savings myths! Take five and watch this year's America Saves Week videos.

Watch the VideosHoliday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, February 21, 2022, in observance of Washington's Birthday.

Due to the holiday, transactions received via Account Access after 3:00 p.m. CT on Friday, February 18, 2022, will be processed as of the close of business on Tuesday, February 22, 2022. Transactions will not be processed on Monday, February 21, 2022.

Potential $25 Incentive for State Employees

On January 18, 2022, the Governor of the State of Missouri – Governor Mike Parson – announced he had included funding in his annual recommended budget for a $25 monthly incentive (match) for state employees who contribute at least $25 a month to the State of Missouri Deferred Compensation Plan (MO Deferred Comp). The budget must be reviewed and would not be fully passed by the state legislature until early May 2022. If approved, the incentive would not be effective until July 1, 2022.

View Full UpdateHoliday Update

The New York Stock Exchange and MO Deferred Comp call center will be closed on Monday, January 17, 2022 in observance of Martin Luther King, Jr. Day.

Due to the holiday, transactions received via Account Access after 3:00 p.m. Central Time (CT) on Friday, January 14, 2022, will be processed as of the close of business on Tuesday, January 18, 2022. Transactions will not be processed on Monday, January 17, 2022.