Meet Your State MATCH

Great news! Effective July 1, 2022, if you contribute at least $25 a month to your MO Deferred Comp account, the State of Missouri will match your contributions dollar-for-dollar up to a maximum of $75 each month. As a state of Missouri employee, those additional dollars saved can make a significant impact on your future retirement income.

If you are currently not contributing the minimum or wish to receive the highest possible matching incentive, you can increase your contribution(s) at any time by following the directions on the How to Change Your Contribution flyer. If you are not contributing to MO Deferred Comp, you first need to Set Up Your Online Access and then you will be able to start/change your deferred comp contribution. New contribution(s) will go into effect following the month you made the change.

How the match works

Here are a few examples of how the match works. If you contribute $25 a month, you will receive a $25 match. If you contribute $52.75 a month, you’ll receive a $52.75 match. If you contribute $100 a month, you’ll receive a $75 monthly match as $75 is the highest matching amount you can receive. The chart below shows several match scenarios as well as what your potential balance could be after 10 or 25 years of saving for retirement with the MO Deferred Comp Plan.

| Your Monthly Contribution | Monthly State Match Contribution | TOTAL Monthly Contribution | Balance in 10 Years1 | Balance in 25 Years1 |

| $20 | $0 | $20 | $3,278 | $13,850 |

| $25.67 | $25.67 | $51.34 | $8,414 | $35,578 |

| $50.89 | $50.89 | $101.78 | $16,680 | $70,533 |

| $75 | $75 | $150 | $24,582 | $103,949 |

| $104.56 | $75 | $179.56 | $29,426 | $124,434 |

| $302 | $75 | $377 | $61,783 | $261,259 |

1Assumes 6% annual return.

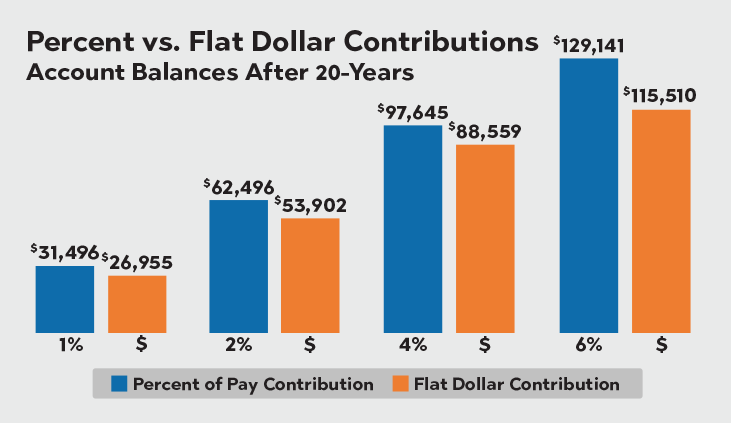

Keep saving with a percent-of-pay

If you are currently saving with a percent-of-pay – like most deferred comp savers – you do not need to change your contribution to a dollar amount to receive the match. Saving with a percentage of your pay has proven to be a better way to save and can help you save more for retirement because percent-of-pay contributions automatically adjust when you receive pay increases and promotions, while flat dollar contributions do not.

Assumes starting salary of $35,000 and equivalent starting flat dollar contribution, 2% annual salary increases, 6% annual rate of return, and a monthly match up to $75 maximum.

You have questions, we have answers.

If you don’t find the answer to your match question below, contact your local financial education professional who can help you and speak directly to your situation.

No, your matching funds will be deposited into your employer 401(a) retirement savings account one time during the month following your contributions. The match is based on your total monthly contributions to the MO Deferred Comp Plan.

Matching contributions from the state are determined based on your previous total month’s contributions and will be deposited in your employer 401(a) retirement savings account the month following. For example, the state match for your contributions for the month of July will be deposited approximately 5 days after August 15, 2022. Your contributions for the month of August will be deposited into your account approximately 5 days after September 15, 2022 and so on.

Your match funds will be invested as pre-tax (i.e. tax deferred) and allocated the same way as your personal retirement savings contributions. You can change the future allocation for your employer 401(a) retirement savings account by following the directions found on the How to Change Your Future Investment Choices flyer.

Yes, you will receive a match if you contribute to Roth and/or Pre-tax retirement savings.

Your state match funds will be invested as pre-tax retirement savings.

If you are currently contributing using a percent-of-pay, you will receive the state match as long as your total monthly contribution meets the minimum $25 requirement.

The matching incentive is funded by the State of Missouri and is subject to the approval of the state’s annual budget and could vary from year to year.

Active state agency employees contributing at least $25 a month to the deferred compensation plan regardless of part-time or full-time status. College and university employees are not eligible.

No, match funds do not count toward the 457 annual IRS contribution limits because employer match funds go into a separate 401(a) account under deferred comp.

Within your MO Deferred Comp account, your money will exist in separate sources: 457 and 401 retirement savings accounts. The 457 contains YOUR contributions to the plan, plus any rollovers to the plan after January 1, 2020. The 401 will contain your employer-match funds, plus any rollovers prior to January 1, 2020. The match is based on your total monthly 457 contributions to the MO Deferred Comp Plan.

State employees can login to the ESS portal to review the deduction on their paystubs. Employees can also login to their accounts directly at www.modeferredcomp.org.

The MO Deferred Comp Plan is a retirement SAVINGS plan and matching dollars from the State of Missouri are based on contributions that you make to that plan.

Your participation in and contributions to either MOSERS or MPERS defined benefit pension plan such as the MSEP 2011 or Tier 2011 plan is not the same as participating and contributing to a retirement savings plan like MO Deferred Comp.

A defined benefit pension plan is not a retirement savings plan. When you are eligible to retire under a defined benefit pension plan, you will be paid a monthly defined benefit based on a mathematical formula calculated using your years-of-service, highest 36 months average career monthly salary and a percent multiplier.